LEDGERFOLIO

FOR CONTEXT

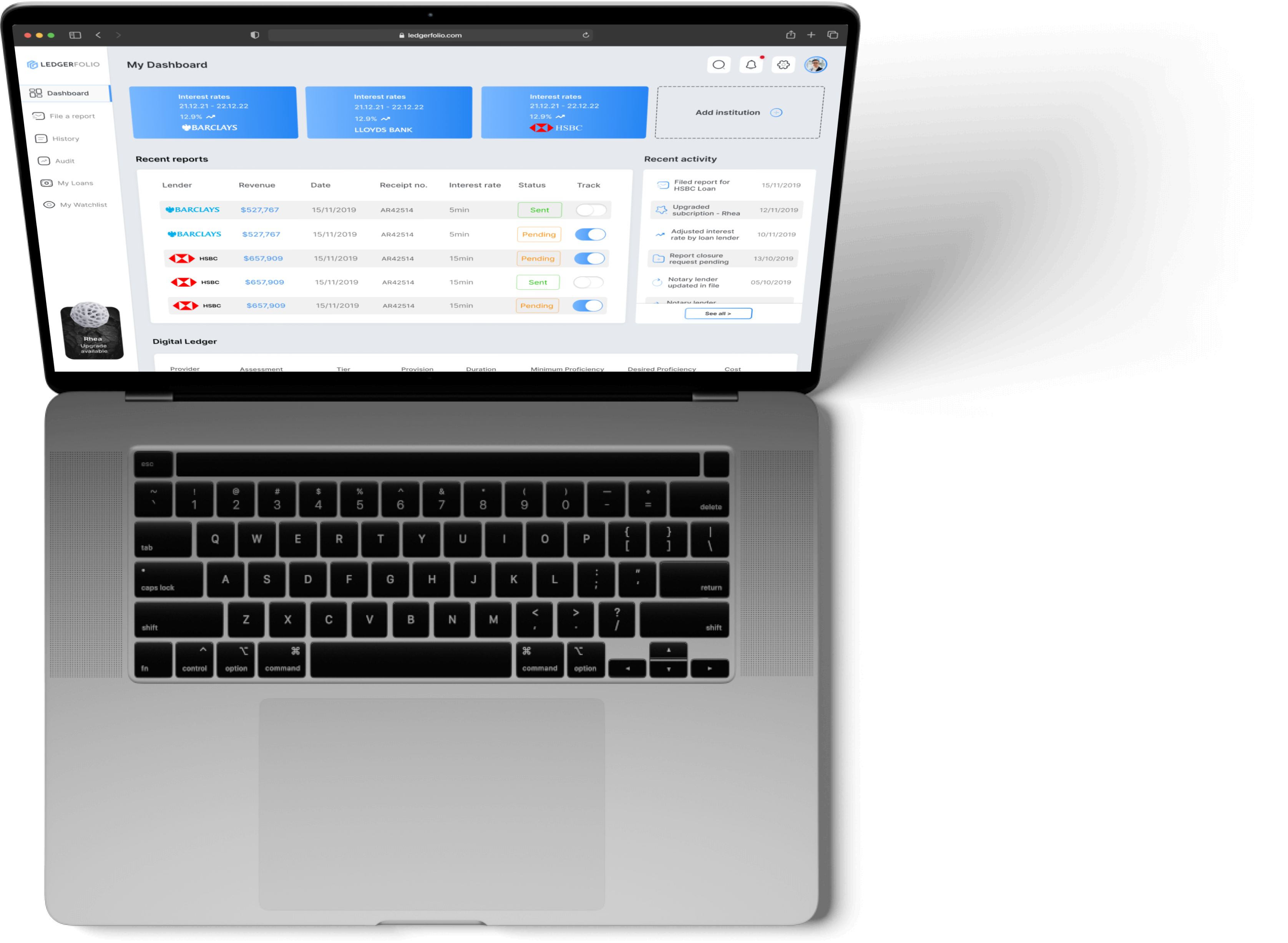

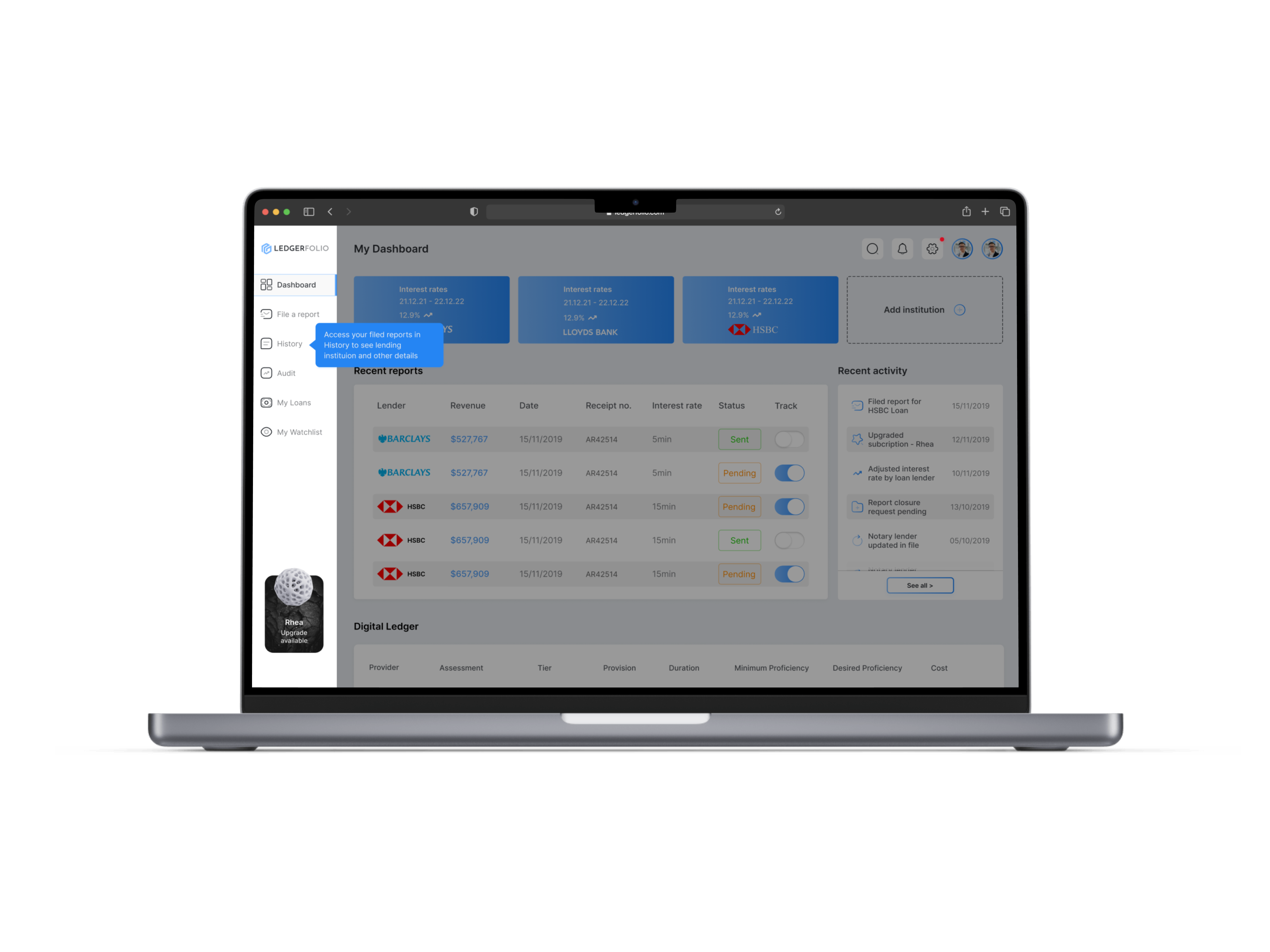

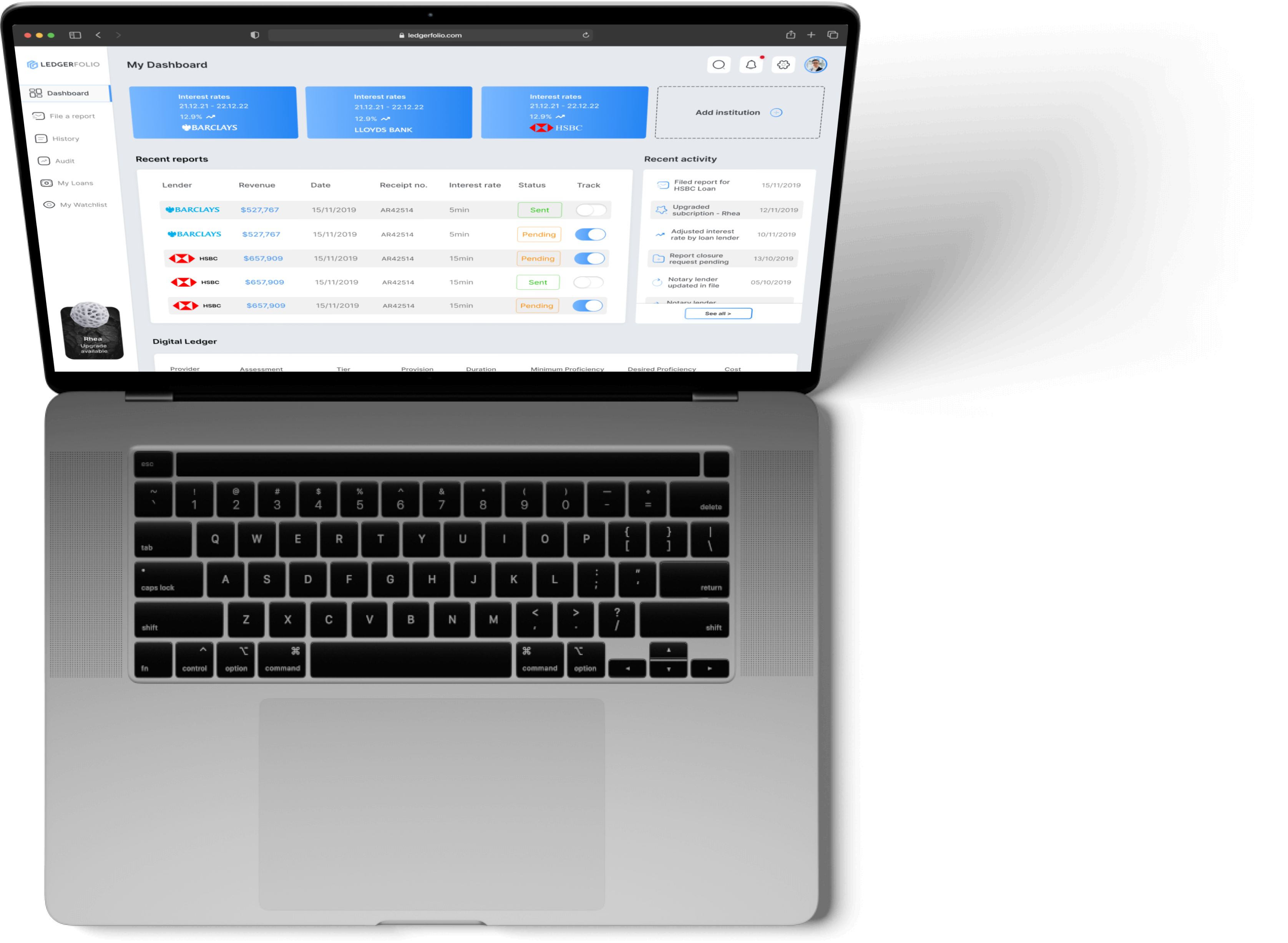

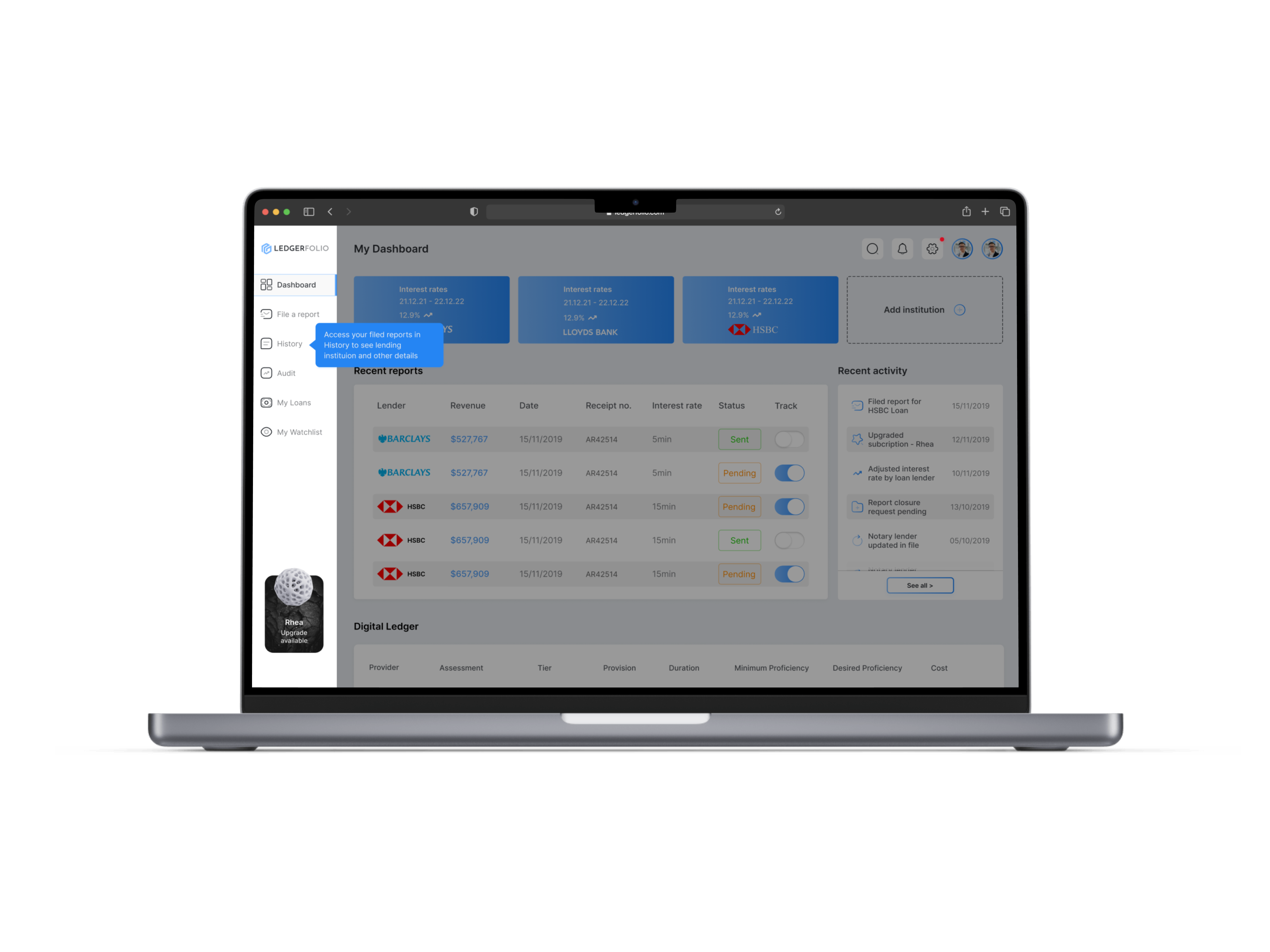

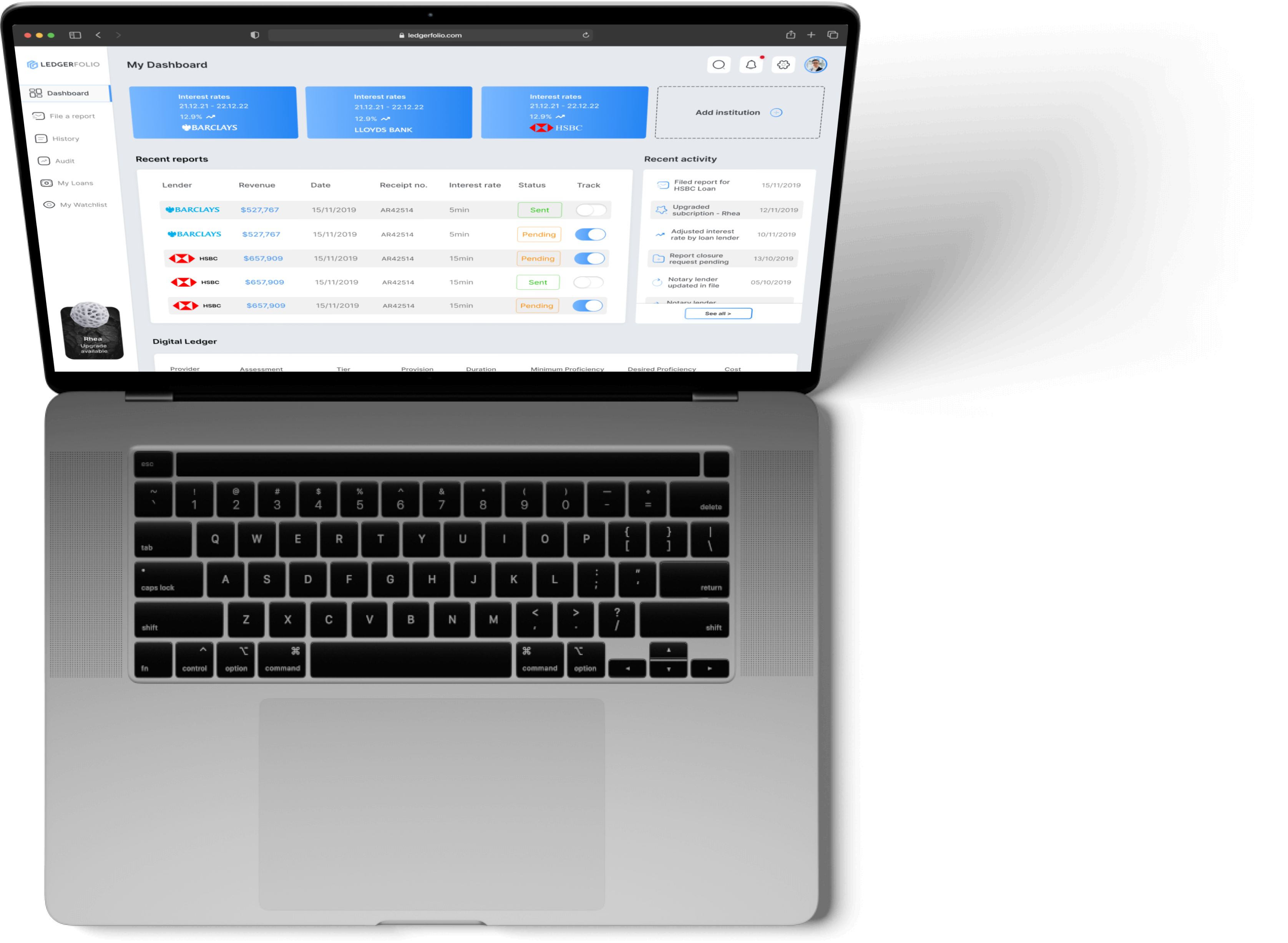

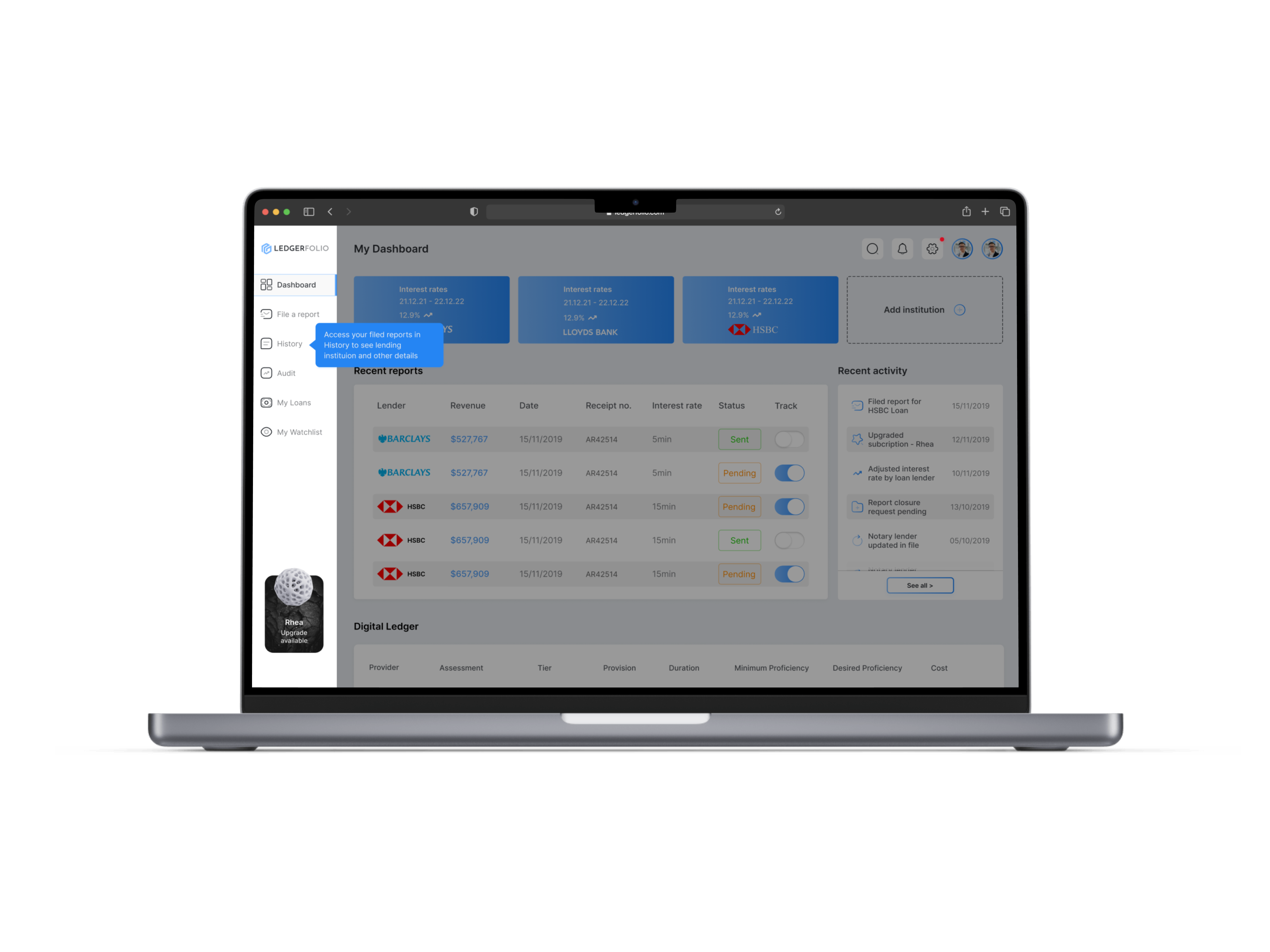

Ledgerfolio is a web application in the debt administration space that specialises in corporate loan settlement. It blends the expertise needed to handle complex loan transactions as a loan agent with new technology to service the the trading and settlement of these loans in the secondary market. It offers all the functions of a traditional loan agent with the added kicker of an online platform to allow clients to close their trades quicker. By allowing users to take control of the process, it saves them time, cost and unnecessary administration.

PROBLEM

The loan market currently doesn’t have an end to end system that takes trades from execution to settlement. Most trade settlements are done by pen and paper and quite literally have to be sent it by borrowers as a word or excel document and then entered manually into the system by loan agents. In an increasingly automated world, this is a huge gap in the system and is not in keeping with the times or with user needs.

SOLUTION

Building a web application that provides all the traditional agency functions required in loan transactions but with a settlement platform that allows straight through processing (STP) of trades. A platform that covers all aspects of trades from pre-trade matching to trade execution and confirmation all the way through to settlement. With everything on one platform, it will allow users to close loan trades quickly with minimal effort.

ROLE

Product Designer

KEYWORDS

Web Application

CATEGORY

B2B/B2C

DESIGN TOOLS

Figma, Sketch

YEAR

2019

Traceable tranches

NYC

Borrower consent

NDA

Credit agreement

Upstream delivery

“A faster settlement window would reduce the difference between loans and bonds. Investors might be attracted to loans that are senior to bonds, but are currently put off by how long loan trades take to settle.”

Source: 2019 European Commission’s report - ‘EU loan syndication and its impact on competition in credit markets.

We had initially planned on a 3 star system to indicate tiers but during user testing, we found that users often felt like they weren’t being treated as importantly when not having all three stars on their profile and thought that it also served as a constantly forced reminder that they weren’t subscribed to the maximum tier.

LEDGERFOLIO

FOR CONTEXT

Ledgerfolio is a web application in the debt administration space that specialises in corporate loan settlement. It blends the expertise needed to handle complex loan transactions as a loan agent with new technology to service the the trading and settlement of these loans in the secondary market. It offers all the functions of a traditional loan agent with the added kicker of an online platform to allow clients to close their trades quicker. By allowing users to take control of the process, it saves them time, cost and unnecessary administration.

PROBLEM

The loan market currently doesn’t have an end to end system that takes trades from execution to settlement. Most trade settlements are done by pen and paper and quite literally have to be sent it by borrowers as a word or excel document and then entered manually into the system by loan agents. In an increasingly automated world, this is a huge gap in the system and is not in keeping with the times or with user needs.

SOLUTION

Building a web application that provides all the traditional agency functions required in loan transactions but with a settlement platform that allows straight through processing (STP) of trades. A platform that covers all aspects of trades from pre-trade matching to trade execution and confirmation all the way through to settlement. With everything on one platform, it will allow users to close loan trades quickly with minimal effort.

ROLE

Product Designer

KEYWORDS

Web Application

CATEGORY

B2B/B2C

DESIGN TOOLS

Figma, Sketch

YEAR

2019

Traceable tranches

NYC

Borrower consent

NDA

Credit agreement

Upstream delivery

“A faster settlement window would reduce the difference between loans and bonds. Investors might be attracted to loans that are senior to bonds, but are currently put off by how long loan trades take to settle.”

Source: 2019 European Commission’s report - ‘EU loan syndication and its impact on competition in credit markets.

We had initially planned on a 3 star system to indicate tiers but during user testing, we found that users often felt like they weren’t being treated as importantly when not having all three stars on their profile and thought that it also served as a constantly forced reminder that they weren’t subscribed to the maximum tier.

LEDGERFOLIO

FOR CONTEXT

Ledgerfolio is a web application in the debt administration space that specialises in corporate loan settlement. It blends the expertise needed to handle complex loan transactions as a loan agent with new technology to service the the trading and settlement of these loans in the secondary market. It offers all the functions of a traditional loan agent with the added kicker of an online platform to allow clients to close their trades quicker. By allowing users to take control of the process, it saves them time, cost and unnecessary administration.

PROBLEM

The loan market currently doesn’t have an end to end system that takes trades from execution to settlement. Most trade settlements are done by pen and paper and quite literally have to be sent it by borrowers as a word or excel document and then entered manually into the system by loan agents. In an increasingly automated world, this is a huge gap in the system and is not in keeping with the times or with user needs.

SOLUTION

Building a web application that provides all the traditional agency functions required in loan transactions but with a settlement platform that allows straight through processing (STP) of trades. A platform that covers all aspects of trades from pre-trade matching to trade execution and confirmation all the way through to settlement. With everything on one platform, it will allow users to close loan trades quickly with minimal effort.

ROLE

Product Designer

KEYWORDS

Web Application

CATEGORY

B2B/B2C

DESIGN TOOLS

Figma, Sketch

YEAR

2019

Traceable tranches

NYC

Borrower consent

NDA

Credit agreement

Upstream delivery

“A faster settlement window would reduce the difference between loans and bonds. Investors might be attracted to loans that are senior to bonds, but are currently put off by how long loan trades take to settle.”

Source: 2019 European Commission’s report - ‘EU loan syndication and its impact on competition in credit markets.

We had initially planned on a 3 star system to indicate tiers but during user testing, we found that users often felt like they weren’t being treated as importantly when not having all three stars on their profile and thought that it also served as a constantly forced reminder that they weren’t subscribed to the maximum tier.